BigTrends Insider Reports

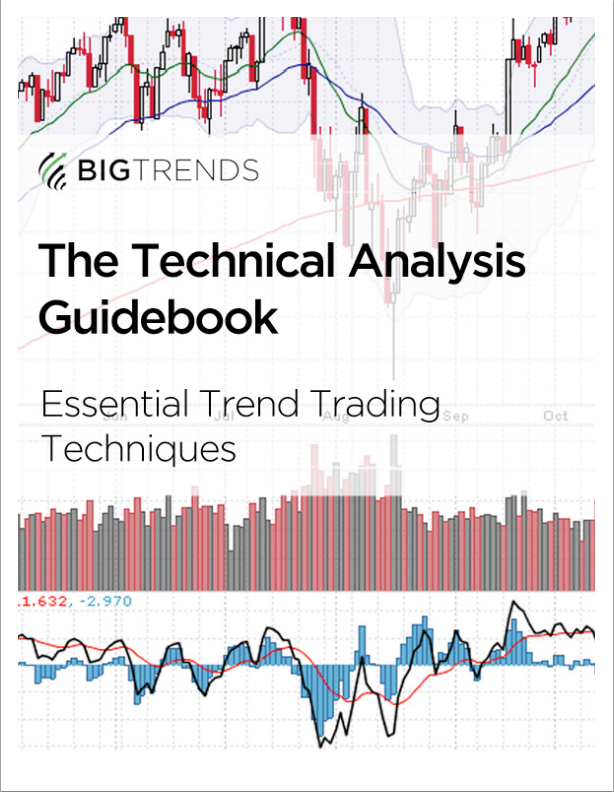

In this extensive 150-page Technical Analysis Guidebook, you will discover the basics of charting, how to identify important chart patterns, the best ways to utilize indicators and how to interpret them, sentiment and how to put all of these factors together to make you a more effective, and more confident, trader.

Using the BigTrends Options Gamma Booster, you can utilize leverage of options to best garner profits on the big breakout signals and find consistent portfolio growth. Included within are real examples from Options Shark, BigTrends’ flagship recommendation service, which can help you to grow wealth consistently by identifying and following the biggest trends.

Very low-cost, out-of-the-money options offer us a unique opportunity to magnify the huge gains being made across multiple stocks in the current market. And by low-cost, that means any option priced at $1.00 or less (that’s no more than $100 per contract) as these discount options can give traders of all levels huge leverage if the trends are caught at just the right time. In this report, you’ll learn how to capitalize on these huge accelerating trends to hit gains of 100%, 200% or even 300% for minimal cash outlay. The trends are out there – you just need the right guide to find them!

So much of the popular media talks about the big moves in Facebook, Amazon, Apple, Netflix and Google. But do you have the confidence to trade them effectively? If you have not mastered this, you’re missing out on a lot of trading opportunities. Trading these so-called “FANG” stocks has become second nature to Price Headley and he want to show you how he combines Weekly Options with a powerful momentum indicator to catch the big trends that regularly occur on Facebook, Amazon, Apple, Netflix and Google. See for yourself how he utilizes Weekly Options as a stock substitute and how you can use this exciting trading vehicle to leverage a stock’s 5% or 10% move into quick gains of 50%, 100% or more! Plus, with dynamic exits and options priced under $10 a contract, you don’t need a huge account or extensive options knowledge to take advantage! They really are perfect for the current market environment.

Learn the ins and outs of the BigTrends Index Options Timer strategy which focuses on selling Weekly Options’ time premium to deliver limited-risk and high-probability weekly trading income on a select group of the biggest ETFs (SPY, TLT and IWM).

With Price Headley’s Simple Trading System, you will learn how Price uses his proprietary Acceleration Bands, as well as his unique take on Williams’ %R and Commodity Channel Index (CCI), to identify and catch the biggest trends in the market. When used correctly and in conjunction, these indicators can drastically improve your winning percentage while decreasing your chances of losing in today’s volatile markets.

As the title suggests, this report features five essential weapons that every aspiring trader must have in their arsenal for effective and continued trading success.